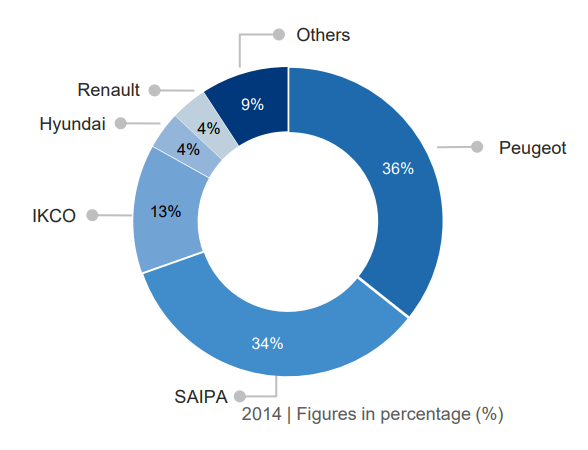

In its 2025 grand economic plan, Iran envisions to become the Middle East’s number one automotive industry of the region, aiming to rank fifth in Asia and eleventh globally.In 2014, the International Automotive Association reported that there were around 13.5 million commercial vehicles in Iran. What strikes the eye when travelling throughout Iran is the large number of foreign brands. As the nuclear deal was being negotiated between Iran and its six international partners, automakers were among the first business sector to re-initiate contacts with Iranian partners – eying a lucrative market with a young and educated population as well as a strategic location to turn Iran into a production hub to export to Russia, the Middle East and Asia. Iran exports vehicles to Middle Easter neighbours, as well as to Belarus, Algeria, Senegal and Venezuela.[1]Demand for cars is on the increase and consequently so is the demand for spare parts. From March 2017 to October 2017, Iran automotive industries registered a 10% year-on-year increase in sales and a 19.7% y/y increase in production.[2]

Uncertainties surrounding the fate of the nuclear deal are unlikely to affect the automotive sector very much since it is mostly concerned with export of spare parts rather than financial transfers.

While China has made important inroads in Iran’s domestic automotive sector during the sanctions era, the lesser quality of the spare parts it produces compares poorly with Western brands. To improve both quality and domestic production, the Iranian government has not only asked automakers to decrease their imports of Chinese products[3] but also strongly encouraged cooperation with Western companies particularly insisting on transfer of technology and knowledge. That said, some private companies in Iran are already manufacturing auto parts of high quality – supplying the domestic market but also exporting their products. Following the signature of the nuclear deal, these companies have increased their cooperation with European partners – by establishing joint-ventures, they further opened the Iranian market to foreign companies and opened a new window of opportunities for their products in European markets.

These joint ventures and partnerships are a prime example of the business model that most benefit Iranian and foreign automakers. Domestic manufacturers can export spare parts that are demanded by their international counterparts. In turn, the latter can export spare parts not produced in Iran. This mutually beneficial relationship has the advantage of circumventing money transfers that continue to be a hurdle despite the promises made by Iran’s international partners in the nuclear negotiations.

Strategically located on the East-West route with export opportunities in the region – encouraged by the government – and a large domestic consumer base, Iran will remain an attractive market for carmakers in the coming decades.

[1]https://financialtribune.com/articles/auto/45397/irans-automotive-advantages?utm_campaign=more-like-this

[2]https://financialtribune.com/articles/economy-auto/73692/iran-auto-market-h1-2017-higher-production-sales

[3]Italian trade Agency report on the Iranian Automotive Market